By Stephen E. Briese

January 20, 2007

Exclusive to: CommitmentsOfTraders.ORG The Commodity Futures Trading Commission began publishing a new COT–Supplemental report last week that, for the first time, details the dealings of commodity index funds in US futures markets. The report will be released each Friday at 3:30 p.m. Eastern as an addition to the existing Commitments reports, which are not affected.

The “COT—Supplemental” introduces a new category of “commodity index traders,” whose numbers were previously commingled with other large trader positions that are reported weekly in the Commitments of Traders In Commodity Futures report. A controversy over the proper classification of these commodity index-related positions led the CFTC, in 2006, to undertake a “Comprehensive Review of the Commitments of Traders Reporting Program.” Commodity index funds typically are static long-only bets on rising commodity prices. At issue, is the amount of capital invested in commodity index vehicles such as mutual funds that finds it way directly, or through swap dealers, into U.S. Commodity futures markets. (An IRS ruling stopped mutual fund dealing directly with swap dealers, adding another middleman, but the bulk of the money is still flowing through swap dealers and into commodity futures and options markets.) Some would call these swap dealers a simple conduit for investor money to reach the futures markets. A better analogy might be a “black hole.”

Traditionally, large traders aggregate positions have been divided into two classifications based on the purpose of their investment. “Commercials” (or the “trade”) had to show that they were using futures for “bona fide hedging” of a cash position in the respective commodity. Anyone else was classified as “non-commercial,” including commodity pools and funds, hedge funds, and their ilk. Since 1936, Congress has limited the size of the latter positions to protect futures markets from excessive speculation that can cause unreasonable or unwarranted price fluctuations and to reduce market manipulation. For instance, an individual speculative investment in the Chicago Board of Trade wheat contract is currently limited to 32.5 million bushels, with a notional value of about $156 million at current prices. This represents about 1.5% of the typical wheat market open interest (analogous to a stock’s market cap).

The COT—Supplemental was the product of the Commission’s “Comprehensive Review,” and addresses complaints both that commingling commodity index funds with traditional commercial hedgers muddied market transparency, and that the popularity of commodity index funds may be responsible for record price levels reached in some commodities like copper and crude oil. If index fund participation has resulted in excess commodity speculation, the CFTC has reason to be defensive. It seems the Commission may be granting speculative trading limit exemptions willy-nilly to swap dealers, euphemistically referring to them as “non-traditional commercials.”

These exemptions are odd in that they grant market access to unregulated intermediaries to an extent that may be denied to the originating investor. A federal court has ruled that swap agreements, in which two parties agree to exchange cash flows from different reference indexes, do not fall under the jurisdiction of the CFTC, SEC, or any federal security regulator. The Commission’s exemption policy can force a regulated pension or mutual fund that runs up against speculative position size limits in commodity futures, to move away from the guaranteed payment of a the regulated exchange to assume counter-party risk in the unregulated netherworld of swap dealers. The swap dealers on the other hand, eat a free lunch: they are granted trading limit exemptions that allow them to deal as a middleman between regulated funds on the one hand, and regulated exchanges on the other, with the associated payment guarantees, while shielding any insight or oversight into their own financial condition or risk profile.

The CFTC has been very defensive about the issue of record commodity prices. As an example, this is what former-acting Chairman Sharon Brown-Hruska told the IMF last June about the complainers: “Engaging in a dime store economic analysis, they see the high prices, particularly in the energy complex, and the increased participation of the swap dealers and funds and they assert that the funds are the probable cause.” The Commission also published a study prepared by its Office of the Chief Economist, that concluded that futures traders were not to blame for record crude oil prices. According to the study, commodity and hedge funds were simply providing liquidity to commercial interests, and no more. Commercials cannot be blamed either. According to the economists, commercials simply adjust their positions in reaction to price changes. The study’s methodology seems quite inventive (which you might expect given the incredible conclusion): “we use highly disaggregated, narrowly defined, position level participant data and for the first known time employ them in a new framework…which, to date, has been surprisingly under utilized in the finance fields” (Haig, Hranaiova, and Overdahl, 2005). Their study cites 40 other works, but fails to address the variation in their findings from those of Garbade and Silber in 1983, that found that in general, futures dominate and lead cash market price changes. This is considered the seminal work in the literature and established the theoretical basis for many later studies. Haig and company certainly should address this discrepancy, especially when their own conclusions appear to be so self-serving.

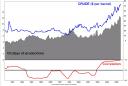

Reading between the lines, the study supports my contention that at the birth of the first economist it was ordained that no economic hypothesis, no matter how daft, be allowed to stretch reason beyond the ability of an economist find its proof. The NYMEX Crude Oil pit is the largest physical commodity market in the world with total open interest approaching $100 bn, where the largest 538 traders currently control positions averaging $165 mil notional value each, employing 20-1 leverage (or better). It seems implausible to conclude that crude prices are set somewhere else and that NYMEX traders don’t affect the price of oil. My own “dime store” analysis suggests a direct relationship between rising open interest and rising prices in crude oil. During the 1990’s the total open interest (number of contracts open) in NYMEX crude oil futures averaged about 5 days of production (see chart). This figure began climbing in 2002, as commodity index funds became popular, and hit 13 days of production at the oil price peak last summer. The bottom of the chart shows a moving 30-month correlation study. Prior to 2002, correlation readings were zero or less, indicating that open interest and price changes were negatively- or non-correlated. But beginning in 2002, correlation readings moved to near 1 (perfect correlation) and remained there, indicating a high positive correlation between rising open interest (buying demand) and escalating prices. Coincidence or causality?

In a prepared statement, the CFTC Chairman Reuben Jeffery III said “The Commission’s decision to begin publishing this additional COT report illustrates the CFTC’s commitment both to maintain an information system that keeps pace with changes in markets and trading practices and to provide the public with accurate and timely data regarding futures and options markets.” The fact that the new report is being issued under a 2-year pilot program and includes only a dozen agricultural markets, however, leaves it open to continuing criticism. Although these 12 comprise fully half of the markets included in the most widely used benchmark, the Goldman Sachs Commodity Index (GSCI), they represent just 17% of the index weighting, a rather stingy sampling.

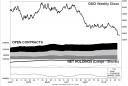

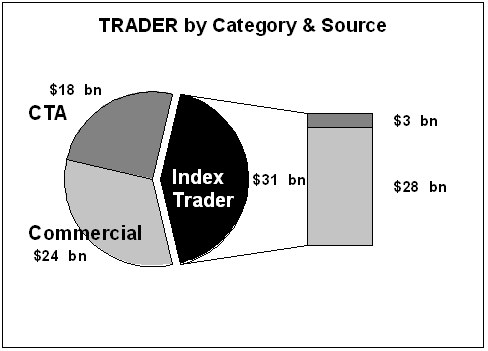

The CFTC’s initial release included weekly historical figures for just the past year, limiting (at least initially) the usefulness of the report to market analysts. Each weekly snapshot is mostly useless to traders and analysts without reference to historical ranges—and the longer the better. Despite these shortcomings, the Supplemental does confirm that commodity index funds have impacted futures markets to a substantial degree. The initial report reveals that index traders have taken over as the largest contingent among reported trader groups. As of the Jan. 3, 2007, tabulation, commodity index funds held long contracts valued at $31 billion–in just these 12 markets. This compares to traditional commercial hedgers at $24 billion and the noncommercial category, which includes CTA commodity funds and hedge funds, who were long $18 billion (all notional values). Even more disconcerting is the comparative concentration of traders. The average commodity index trader’s position is 1.8 times the size of the other large traders. This new business has, of course, benefited the exchanges and their memberships enormously, with record volume spawning IPO’s by the 3 largest futures exchanges, including the NYMEX, which topped all other IPO’s in 2006. It has also, I suppose, enlarged the portfolio of the market regulator, always a boon to the prestige, if not the power of a bureaucracy.

But this business has been a bit one-sided, if these 12 markets are any indication. The index traders have added 75% to long open interest, but next to zero on the short side. Futures are zero sum markets, where there has to be a seller for every buyer. The corn pit doesn’t differentiate buying by a manufacturer of cornflakes, from a commodity index investor who doesn’t even eat cornflakes; all it sees is demand for corn. The current report shows that demand for actual agricultural products (whether from China or India or whoever gets blamed) is overshadowed by investment demand. This unbalanced buying demand is unique to these commodity index traders and unprecedented in commodity markets. A micro economist might find a disconnect between classic supply-demand curve theory and the CFTC economists’ contention that futures investors are not behind record oil prices (or by implication, sky-high prices in gasoline, heating oil, gold, silver, copper, platinum, cattle, hogs, corn, wheat, orange juice, or sugar).

The COT-Supplemental report also confirms the beliefs of many critics who thought these index-related positions were probably being (mis)categorized as commercial traders, a practice that has made it impossible to judge how much buying represented real raw material demand as opposed to speculative or investment demand. The new index trader total includes $28 billion removed from the “commercial” category, while just $3 billion came from the speculative fund total. In other words, in these 12 agricultural markets—Chicago wheat, Kansas City wheat, corn, soybeans, soybean oil, cotton, hogs, feeder and live cattle, cocoa, international sugar, and coffee—55% of recent buying demand thought to be commercial trade related was in reality investment demand.

The COT-Supplemental report also confirms the beliefs of many critics who thought these index-related positions were probably being (mis)categorized as commercial traders, a practice that has made it impossible to judge how much buying represented real raw material demand as opposed to speculative or investment demand. The new index trader total includes $28 billion removed from the “commercial” category, while just $3 billion came from the speculative fund total. In other words, in these 12 agricultural markets—Chicago wheat, Kansas City wheat, corn, soybeans, soybean oil, cotton, hogs, feeder and live cattle, cocoa, international sugar, and coffee—55% of recent buying demand thought to be commercial trade related was in reality investment demand.

The new report seems to confirm one contention of the commodity index fund apologists, that this is sticky money invested for the long-term. Index traders increased their commodity holdings over the past year, even as commodity prices tumbled. The GSCI, for instance, is down 23% from its high mark set last July. During the same period index traders increased their long commodity holdings by 3%. Based on this, you could argue that index traders may currently provide a stabilizing presence. Seasoned commodity traders are well aware that every price boom nurtures supply and stifles demand, leading to an eventual and inevitable bust. The new COT—Supplemental may warn us when market losses finally force commodity index investors to rethink their long-term objectives (and perhaps become a destabilizing force).

We may even be able to make reasonably accurate guesstimates for the markets left out of the new report. Taking the GSCI as the benchmark, and assuming that commodity index funds made proportional investments in the other component markets, we can project total index-related commodity holdings of around $180 billion. This seems to jive with estimates of total index fund investments, which range between $100 and $200 billion. More importantly, it points out that the bulk of commodity index funds have, indeed, found their way to US futures markets. It is hard to see how this much added volume won’t magnify commodity price movements, both up and down.

Past public demand has pressured the CFTC to increase the frequency and decrease the delay of the CoT report. When I began subscribing in 1974, the report—then 12 years old—carried month-end totals and arrived by mail about the middle of the following month. Now it is released on the Internet each Friday, showing trader positions as of Tuesday’s close. This is by far the most popular destination on the www.cftc.gov website, attracting more than 8,800 viewings in an average week. The report can be a great playing field leveler. Traders use the report to anticipate market trend changes based on the relative spread between commercial and noncommercial trader positions. Large speculative funds favor momentum trading strategies, which means they typically are most heavily committed—in the wrong direction—at market turns.

Even the biggest and most experienced can get it wrong, and even the smallest private trader may pick up on this. Last July, for example, while regaling the Playboy interviewer with his hedge fund’s performance figures (published in the January issue, T. Boone Pickens predicted that crude oil would never again see $50, and would hit $80 by year-end. But at the same time, the Commitments of Traders report showed that Pickens had too much company. Commodity and hedge funds had equaled their largest notional long bet in the history of NYMEX oil trading—more than $15 billion. It was pretty clear that all of the potential buyers had bought, and that prices were about to fall—not due to any fundamental development or even necessarily because crude was overpriced. Prices were going to fall simply because there weren’t any uncommitted buyers remaining to bid prices up. These trader positions were tabulated on August 8, the day crude prices challenged but failed to penetrate their April record and it has been downhill ever since.

These types of market insights are common enough that when the Commission, as a part of its Comprehensive Review, raised the possibility of discontinuing the CoT report, they were slammed with a record 4,659 public comments, all but one strongly supporting the continuation and enhancement of the report. The one, notable, dissenter was the International Swaps and Derivatives Association (ISDA), which strongly recommended against any more revealing reporting that could affect its members. But it did propose a compromise: “If the Commission decides [to expand reporting], we recommend that any additional reporting be in a no more than a two-year pilot program that we would be prepared to work with the Commission to design with a limited number of commodities.”

It is not known how much assistance the ISDA may have provided, but the new report is, indeed, a two-year pilot program and covers a very limited set of markets—certainly no more than 20% of the ISDA membership’s commodity positions. Even more revealing than the unusual influence the ISDA carries with the Commission, is admission the ISDA provided in their comment letter regarding the need to protect their members’ anonymity. Perhaps they thought their public comments would not be made public: “In a dispersed market, the risk of reverse engineering would be low, but the non-traditional commercial [commodity index] category is highly concentrated, with, we believe, the top four swap dealers composing over 70% of the category. In some of the lower-volume commodities markets, only a single swap dealer is a dominant participant.” Finding it impossible to resist a dare, so I made some simple reverse engineering calculations, and the results are stunning. The 4 swap dealers mentioned appear to control between them 30% of the entire long open interest in the 12 reported markets where total investment demand topped physical product demand by 80%. Projecting to total commodity futures market positions, the figure is an astounding $125 billion, or $30 bn each of the 4 swap dealers. This suggests that my earlier market concentration calculations significantly understate the intrinsic risk. What happens if one of these exempt swap dealers goes belly up? We, of course, can’t calculate the risk of this because of the lack of regulatory oversight of swap dealers.

The Commission is undoubtedly under feeling the pressure, caught in the middle trying to square the demands of the 4 jumbo swap dealers with their own statutory duty to protect futures markets from excessive speculation. In light of the new report’s revelations, the Commission should be commended for initiating COT—Supplemental, despite its limited coverage. For 45 years, the Commitments of Traders report has provided greater market transparency than the public accounting available in any market in the world. Certainly we want to encourage the Commission to continue this kind of leadership.

At the same time, you may also want to send the Commission some help by offering a word of encouragement to Sen. Barbara Boxer on the Agriculture Commitee. In December, the California Democrat blocked the President’s nomination of Jill Sommers to fill the CFTC Commissioner’s opening left by the departed acting-Chair Brown-Hruska. Sen. Boxer voiced concern for what she called the “Enron loophole” that allows swap dealers to operate without federal oversight. (She was referring to specific executive actions, beyond those detailed here, initiated by former CFTC Chair Wendy Graham, as well as specific legislative assistance sponsored in Congress by Senator Phil Graham while his wife sat on Enron’s board, that insured that neither swaps nor swap dealers would ever be accountable to federal or state regulatory oversight.) Senator Boxer intends to try to narrow this loophole and may feel that appointing Sommers, the former Chief US Lobbyist for the afore mentioned International Swap and Derivatives Association, to the CFTC Commissioner’s post might be akin handing the fox the keys to the henhouse.

-End-

-End-